Fiscal Citizenship

Am 1. März 2021 startet ein dreijähriges interdisziplinäres Forschungsprojekt mit einem Budget von 1,5 Mio € im Rahmen des Open Research Area-Programms, das gemeinsam von der DFG, dem kanadischen SSHRC und dem britischen ESRC finanziert wird. An dem Projekt ist auch der Lehrstuhl für Öffentliches Recht, Deutsches, Europäisches und Internationales Steuerrecht beteiligt, der aus den Projektmitteln eine auf drei Jahre befristete halbe Mitarbeiterstelle finanzieren wird. Projektbeginn ist der 1. März 2021.

Das Projekt mit dem Titel “Fiscal Citizenship in Migrant Societies: An International Cross-Country Comparison” soll unser Verständnis dafür verbessern, welchen Einfluss die Einstellung der Bürgerinnen und Bürger zum Staat auf die Bereitschaft Steuern zu zahlen hat. Das interdisziplinäre Projekt bedient sich dabei verschiedener Forschungsmethoden und wird in den drei beteiligten Ländern parallel durchgeführt werden.

Background

Taxation is necessary to the proper functioning of the modern welfare state and payment of taxes can be thought of as a unifying act that brings us together to further our collective goals. Taxes touch our lives in many ways and our willingness to contribute through paying taxes, understood in our project as “fiscal citizenship”, is complicated. All countries have a fiscal culture i.e. social norms around paying taxes and ‘tax morale’ or how citizens feel about paying taxes. Our comparative project will address this important issue in a study that comprises Canada, Germany and the UK and that includes the impact of demographic change in the form of migration, on established taxpaying norms.

In the face of economic instability and costs associated with the COVID-19 crisis, coupled with increasing migration, securing funds to support the welfare state is a pressing issue. However, our study is not only important for developing policies that support and encourage fiscal citizenship but will also shed light on the broader question of how political and institutional context shapes citizens' preferences and societal integration. Attitudes towards paying taxes also provide a window into wider aspects of modern society such as social norms, respect for authority, trust and cultural traditions.

It is surprising that we currently know little about the relationships between citizenship, migration and fiscal citizenship, which means that tax systems and collection policies may not be designed in the most efficient way. Over the last 3 – 4 decades, Canada, Germany and the UK have each experienced a large influx of migrants from a wide range of other countries, each with their own fiscal culture. These changes in the make-up of our societies inevitably impact on fiscal citizenship. Newcomers bring with them experiences of their home countries and may not readily adapt to the new fiscal culture, which itself may need to modernise to be more inclusive. This has implications not only for tax authorities trying to collect tax as best they can, but also for existing citizens who may experience a change in their own willingness to pay taxes.

The Project

We will seek the views of a wide range of participants through surveys, interviews, and experiments in our three countries to improve our understanding about national fiscal citizenship. The project's interdisciplinary research agenda will interest scholars and policymakers working on issues related to migration, fiscal citizenship, and the intersection between the two.

The Team

Canada

Kim-Lee Tuxhorn, Assistant Professor of Political Science, University of Calgary

Jonathan Farrar, Associate Professor in Accounting, Wilfrid Laurier University

Till-Arne Hahn, Assistant Professor Accounting, HEC Montréal

Germany

Dirk Kiesewetter, Professor of Tax Accounting, Julius-Maximilians-Universität Würzburg

Martin Fochmann, Professor for Accounting and Taxation, Freie Universität Berlin

Hans-Joachim Lauth Professor of Comparative Politics and Systems Studies, Julius-Maximilians-Universität Würzburg

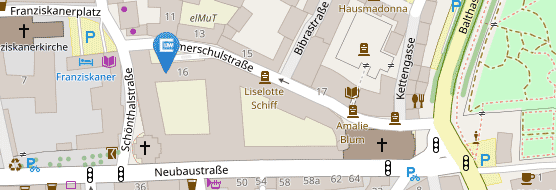

Ralf Schenke Professor of Public Law, German, European and International Tax Law, Julius-Maximilians-Universität Würzburg

UK

Lynne Oats, Professor of Taxation and Accounting, University of Exeter

Oliver James, Professor of Politics, University of Exeter

Lotta Björklund Larsen, Research Fellow, Tax Administration Research Centre, University of Exeter